Handmade cards versus. Personal loans: Whats Right for you?

Either you should borrow money to journey away a monetary emergency. To find the versatile funding need, you may look to handmade cards and private financing to help. But how are you aware of what type is right for you as well as your needs?

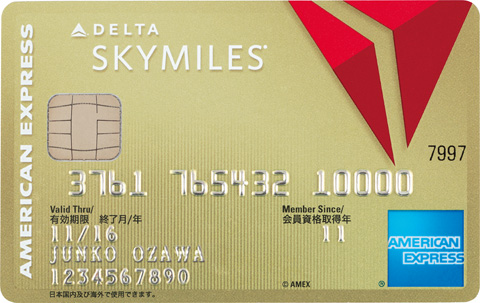

Playing cards

You probably currently have experience having fun with credit cards. It’s the most common personal line of credit, a kind of funding you to definitely enables you to borrow funds as needed, to an enabled matter. Because you pay back the bill, also desire, that money be available for play with once again. Handmade cards are a great selection once you plan to:

- Build short, spread-aside installment loans Cleveland sales. Mastercard funds should be utilized since you need them, as long as you never strike their borrowing limit. Therefore if the costs are small and thrown, you could borrow money as required which have credit cards.

- Consolidate a reduced amount of financial obligation. If you are searching to ease the strain from multiple higher-rate bank card stability, consolidating your debt and you can mobile they to one down- speed cards could help. Particular credit cards possess an equilibrium import percentage, but some do not. Having said that, signature loans may hold origination and you may closing costs. When contrasting your options, believe one charges you are able to incur and the notice speed.

- Has actually independency with cost. Lowest repayments have to be generated per month on the bank card harmony. However you aren’t expected to pay back your entire balance by a particular day. However, desire basically will continue to accrue towards remaining equilibrium.

Signature loans

Unsecured loans form much like automotive loans. You obtain a lump sum away from a loan provider, and then you make fixed monthly premiums that have been determined to repay the whole equilibrium contained in this a certain timeframe. A personal bank loan might possibly be most effective for you if you are planning to:

- Financing a large expense. Of numerous playing cards include a borrowing limit away from $5,one hundred thousand. If you wish to use more funds, you will probably you prefer a personal bank loan. You may want to play with a personal bank loan so you’re able to consolidate an enormous quantity of high-notice loans, so that you only have one repaired payment.

- Improve same commission month-to-month. The minimum expected commission to have credit cards usually varies from every month. If you would like depend on a normal payment count as you are able to include into the finances, upcoming a consumer loan is the top complement.

- Limit your ability to spend. Handmade cards allow for a lot of unlock-concluded expenses. Conversely, money out-of a personal bank loan is approved initial from the count need. If you have trouble with overspending, a consumer loan might help make certain you might be focused with exactly how spent.

Bringing Your Back on the Ft

One another playing cards and personal finance let you borrow funds to possess whatever of your needs. You might discuss the new pricing featuring out of DCU handmade cards and personal financing on the internet.

Please be aware one to membership is needed to discover a good DCU Charge Platinum Credit card also to deal with a beneficial DCU Personal loan.

This information is having informative motives merely. It is not designed to act as judge, economic, investment or tax guidance otherwise mean that a particular DCU unit otherwise provider is right for you. Getting certain advice about your specific things, you can even want to consult a monetary top-notch.

*Earn more was a sweep element. Eligible balance are automatically swept out to FDIC and you may/otherwise NCUA covered deposit levels stored within performing loan providers through the the country. You continue to have access to your own family savings financing. The ability becomes activated into to begin the day adopting the the new few days subscription took place. The fresh ability can just only be added to one family savings for each and every subscription, leaving out HSA Examining accounts. Find out more about the latest Earn much more Element here.

OMG-inducing, share-compelling, like-attracting, clutter-breaking, thought-provoking, myth-busting content from the country’s leading content curators. read on...