So what does the brand new prepared obligations-to-earnings ratio changes imply to possess basic-homebuyers and you can possessions traders?

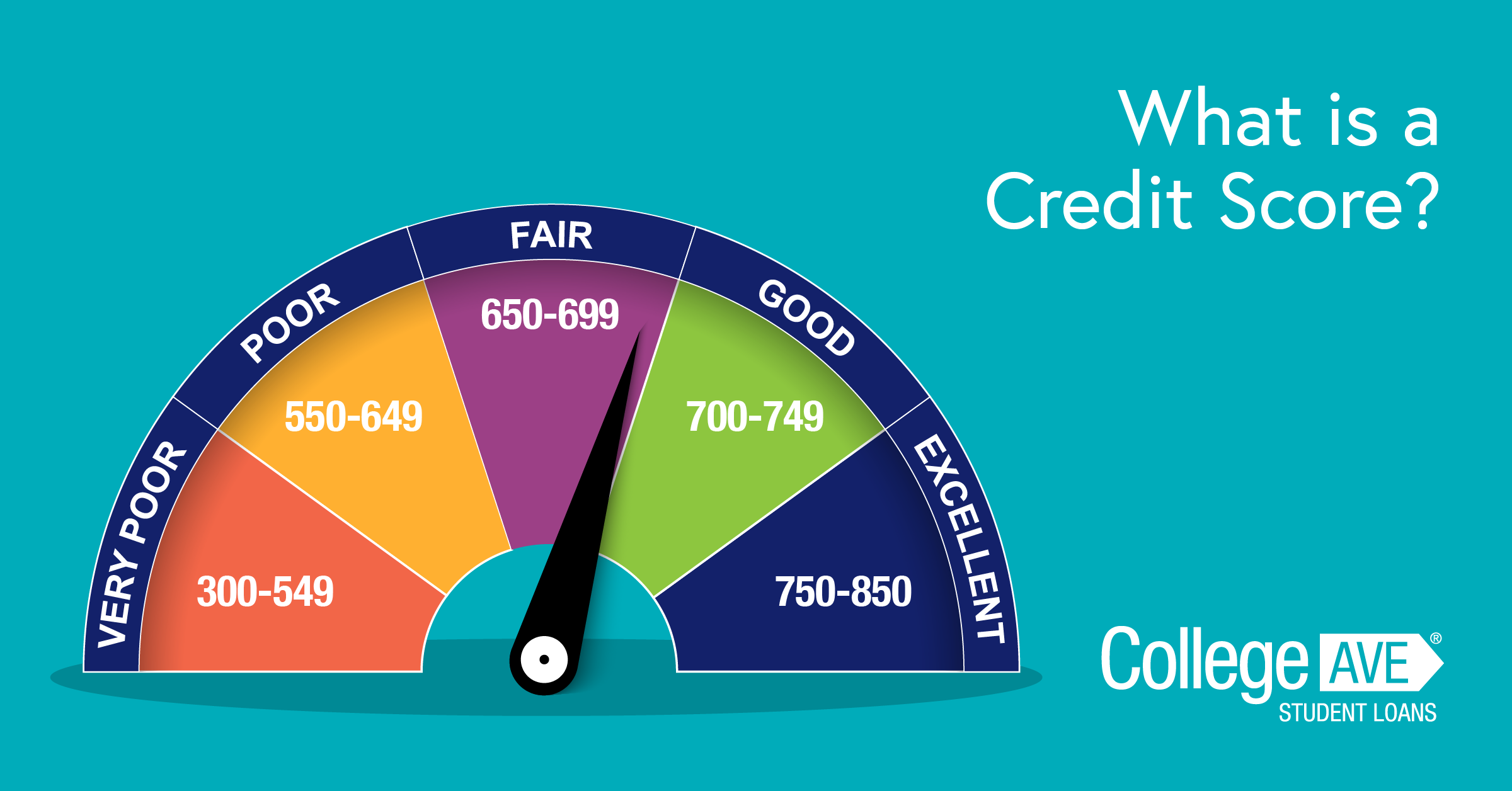

What exactly is a personal debt-to-earnings ratio?

An obligations-to-income proportion methods the level of financial obligation an individual or household provides than the its income and will be offering a snapshot of the economic balances and you will ability to make typical mortgage payments. He could be a switch factor that lenders consider whenever deciding whether or not to agree home financing app because they are an enthusiastic very important measure of monetary balance and you will risk. All the debts one to potential consumers provides will have to be added throughout the DTI formula, also personal loans, credit debt, and you can student loans, along with the mortgage loans he’s taking on.

What is the Put aside Financial believed?

Into 2021, the latest Labour Regulators accessible to supply the Reserve Financial the benefit to put DTI control toward lender credit. This was at a time whenever issues about highest home prices have been peaking. Already, due to went on stress into rates of interest therefore the discount, the newest Set-aside Bank is expected to make usage of limitations into the DTI inside the next 12 months. Despite the lack of a proper announcement, the newest Set aside Lender contains the authority introducing this type of legislation during the their discretion, as it seeks to bolster the latest resilience of savings.

DTI laws and regulations have a tendency to enforce limitations towards extent that individuals can take for the loans loan places Luverne with regards to its income when you take to the a home loan. This may avoid banks from providing brand new home loans to customers that has an obligations-to-earnings (DTI) proportion of more than a particular top.

The last matter hasn’t been set, nevertheless Reserve Financial will likely entice good DTI regarding 6x otherwise 7x annual income. Such as for example, in case your DTI was 6, consumers who’d a yearly money before income tax off $100,000 do simply be in a position to borrow as much as $600,000 for a home.

How can i Raise My Financial obligation in order to Income Proportion?

There are several a way to improve your DTI proportion. You to efficient way is to pay financial obligation, prioritising large-focus charge card stability and you will probably settling down monthly obligations which have loan providers. A special approach comes to increasing your income, that will reduce your DTI proportion because of the increasing the denominator inside the this new formula. On top of that, refinancing financial obligation also can straight down monthly obligations and you can replace your DTI ratio. This can include consolidating obligations with the that loan with a diminished rate of interest or extending the loan term, making it possible for deeper cash flow to get into overall loans prevention.

Are DTI rates anything to love?

An important concern towards the every person’s mind is how DTI rates tend to effect some one together with market. For first-home buyers, banks have already incorporated comparable limitations and you can buffers to suit this type of rates. Particular financial institutions have previously proactively integrated DTI percentages within their financial recognition methods. These types of percentages serve as a simple unit to have mortgage lenders so you’re able to assess the credit risk in the somebody otherwise property.

Assets buyers and you can home owners having generous mortgages will have the results of a loans-to-earnings ratio. This type of organizations are for the to purchase functions during the raised ratios. For individuals who belong to this category, it could be smart to talk with an economic agent to ascertain what the best option is for your.

As well as, certain conditions exists into DTI legislation, brand new makes, including, was excused from these statutes. For this reason, if you are investing an alternate build, DTI restrictions are not a concern.

Conclusion

To summarize, because the advent of loans-to-earnings ratios may increase issues, it is important to recognise that numerous banks currently use similar limitations and you will buffers within their lending strategies. DTIs try a common tool used by many mortgage lenders. More over, there are lots of exceptions to the guidelines. Some one need certainly to stay told about such changes, but full, brand new effect may not be while the stunning because it first looks.

Seeing top fiscal experts, such as the faithful cluster on Rapson Money & Fund, also provide valuable knowledge and you can suggestions designed to specific things. Contact the group.

OMG-inducing, share-compelling, like-attracting, clutter-breaking, thought-provoking, myth-busting content from the country’s leading content curators. read on...