Do Navy Government Create Design Financing? All of your Concerns Responded

Tough Money Mortgage Selection (855)-244-2220

Navy Government Borrowing Union (NFCU) also offers some top quality financial choices for armed forces users and you will veterans. It’s not only one of the top borrowing unions from the country and in addition a competitive supplier out of U.S. Department off Pros Things (VA) funds having glamorous costs no-down-payment solutions.

If you’re looking to own Navy Federal build financing, you’re in to have disappointment just like the, in the course of writing this article, the credit connection will not particularly give design funding. That doesn’t mean you have got to stop, even when.

Many consumers was unaware that certain NFCU programs could work to possess your in case you have reasonable-degrees structure performs. For those who have surface-right up or this new construction arrangements, the credit partnership advises taking another framework loan ahead of refinancing with a convenient NFCU home loan. I have wishing this guide to help you find out both this type of alternatives and provide particular solutions.

Lesser Construction Finance during the Navy Government Credit Relationship-Viable Choice

When you have a current assets with equity inside it, you can try the brand new collateral-dependent software Navy Government Credit Connection has the benefit of. These things are removed for remodeling a current household otherwise appointment almost every other capital or individual requires.

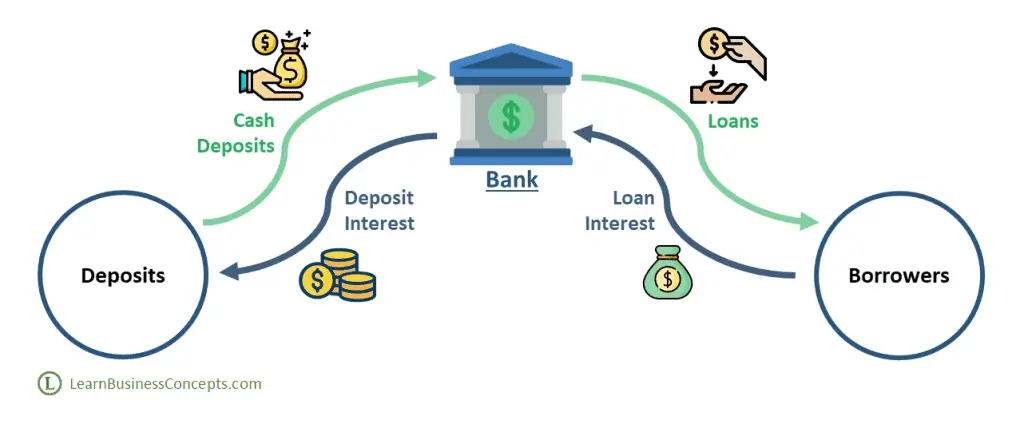

Domestic guarantee, for the simple terms, is the property value the home without having the a fantastic mortgage loans. Instance, your existing home is really worth $500,000 possesses a good $two hundred,000 financial harmony-new equity of your home might possibly be $300,000. Equity-situated NFCU factors makes it possible to pull that $300,000 and place it into a coveted socket, along with framework programs.

- Navy Federal domestic security financing

- Navy Federal domestic equity line of credit (HELOC)

As opposed to normal structure fund, these things don’t need the debtor presenting outlined drawings, costs, and you can mark dates, mainly because he’s got flexible spends. Let’s take a glance from the these items.

Navy Federal Home Equity Mortgage

Household collateral loans are common products provided by every big bank, credit commitment, and you may mortgage company. Although many companies lend you doing 80% of your security you really have gathered in your assets, NFCU could possibly offer your 100% of your guarantee part. Take a look at the important attributes of NFCU family guarantee money:

Regardless of if it is really not a houses-certain device, a property guarantee financing should be compatible if you want a lump sum payment having restoration, solutions, or any other building work equivalent to the newest equity you leveraged.

Navy Government Home Equity Credit line (HELOC)

HELOCs are conceptually like family guarantee financing-you power the newest guarantee of your house for a financial loan. The only huge difference is that HELOCs work particularly charge card financial support. The fresh new security-established loan belongs to a drawing membership, enabling you to withdraw currency during the place restrict because you delight. You pay https://paydayloanalabama.com/dutton/ interest just into the a good harmony.

NFCU has the benefit of HELOC finance for 95% of your house equity. Here you will find the prominent popular features of this product:

NFCU’s HELOC bundle is less high priced when compared to comparable facts given by other mortgage lenders. Its right for undertaking enough time-drawn-out framework work, but you normally have to blow highest interest levels just like the big date moves on.

Normally Navy Federal Assistance with a different Structure Loan?

Navy Federal currently has the benefit of no services regarding the fresh new framework. When you need to make use of their lowest-prices mortgage agreements, a smart strategy is to get a casing-only financing of an alternate bank. Because the construction is prepared, connect with NFCU having a normal otherwise Va mortgage (with rates including 5.375%). Whenever you are accepted, you should use the continues to settle the development mortgage.

OMG-inducing, share-compelling, like-attracting, clutter-breaking, thought-provoking, myth-busting content from the country’s leading content curators. read on...