cuatro Errors And that Result in A bad credit Get Having A house Financing!

If you have ever removed playing cards or all kinds regarding financing, you will be used to the expression crappy credit history. But if you are fresh to dealing with your finances and record your money, take note that your particular credit rating installment loan companies in Appleton WI try regarding much notice to help you a bank specifically for home financing app.

Therefore, what exactly is a credit history?

A credit history was a four-little finger well worth inside good numeric format that’s predicated on a borrower’s creditworthiness. Its a switch metric employed by lenders to determine exactly how deserving could you be of getting a mortgage in addition to probability of you being able to shell out one to home loan back prompt.

From inside the Singapore, credit history cover anything from 1,000 and you will dos,000 the greater your credit score, the greater youre sensed economically secure, and you may find your way to a different home, automobile or anything else need a great deal simpler.

A card agency spends its own algorithm in order to assess credit score. While the precise formula isnt in public places known, we realize exactly what circumstances are believed of the loan providers in order to compute borrowing score. The factors taken into consideration include fee records, credit utilisation proportion, age/lifetime of credit lines, quantity of borrowing inquiries made and some other people.

Inside Singapore, the credit Bureau away from Singapore (CBS) plus the Experian Borrowing from the bank Agency (ECB) combine and gather your credit history and you will payment behaviour to provide full borrowing from the bank chance pages so you can loan providers.

Understanding the thought of credit history being alert to new preferred problems that can affect harm their credit ratings are crucial. This article will help the website subscribers understand the most frequent distress consumers has from the credit ratings and how to avoid such problems.

Why does a credit rating count?

If you are planning when planning on taking up any style regarding borrowing otherwise mortgage, should it be making an application for a construction financing, auto loan, or thinking about searching for advanced schooling, you will need to invest in your aim by using assistance from a financial. Once you submit a credit card applicatoin with the financial, they will get your credit history regarding the borrowing from the bank bureau and check your credit rating to assess your own creditworthiness.

Your credit score isn’t just what you can do to pay financing right back but it is more and more debt reputation of spending money. You should check your credit score with CBS 100% free if you really have recently applied for a different sort of credit facility which have one lender (that is a great CBS user) or you can just pay $6.42 via Bank card, Visa, or eNets to really get your credit report.

For lenders, an excellent credit history that have CBS mode a high odds of getting your loan application acknowledged and having the loan amount you desire to obtain. On top of that, a terrible or less than perfect credit get might get your loan application declined.

Whenever you are applying for an HDB mortgage and not a full-time staff member which have monthly CPF contributions, HDB may wish to availableness your own creditworthiness as part of the HDB Home loan Eligibility (HLE) process. While the HLE standards cannot primarily consider your credit history, as an alternative it will require into account your children functions, income top and you will past HDB financing brought to date.

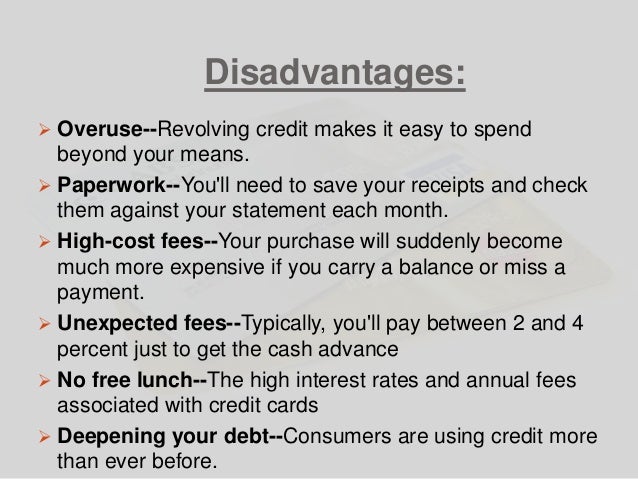

Mistake #1: Obtaining unnecessary playing cards otherwise financing

We simply cannot blame your entirely for finding lured to security the bases’ and implement getting multiple credit cards otherwise money considering enticing bank card positives approximately-entitled top financial income offered by finance companies, however it is the most significant mistake you could make. Which have so many playing cards or funds been several credit inquiries, which can make you appear bad regarding vision of your loan providers.

OMG-inducing, share-compelling, like-attracting, clutter-breaking, thought-provoking, myth-busting content from the country’s leading content curators. read on...